Report Details Emerging Trends in Payment Card Fraud

Jim McKee

Congress, banking regulators and the payments industry have spent the past six months debating the strengths and weaknesses within the payments infrastructure (see Retail Breaches: Congress Wants Answers).

2014 Fraud Summit Agenda Released - View Session Details >

The catalyst for the debate is the explosion of card fraud linked to retail and payments processing breaches. But while point-of-sale network breaches that have compromised Target Corp., Sally Beauty, P.F. Chang's China Bistro and others are a concern, so are upticks in skimming attacks and ATM cash-out schemes that have defrauded banks and cardholders.

Now, the Federal Reserve Bank System, in its just-released 2013 Payments Study, is shedding light on emerging fraud trends related specifically to payments. This is the first time the Fed study has addressed fraud related to payments, and what it confirms is that card fraud is banking institutions' greatest pain point.

The majority of fraud reported by U.S. banks in 2012 resulted from unauthorized card transactions, not ACH, wire and check. And while the study does not specifically call out whether those fraudulent card transactions were linked to a retailer or payments-processing breach, the findings illustrate the growing challenge card issuers face when it comes to preventing card fraud, experts say.

According to the study, in 2012, 13.7 million fraudulent transactions involved credit cards, totaling $2.3 billion; 14.9 million involved debit or prepaid cards, totaling $1.5 billion; and 1.3 million, totaling $300 million, were categorized as fraudulent ATM withdrawals.

Setting a Baseline for Fraud

Industry experts say the new fraud data in the study, even though it's based on a 2012 survey of more than 1,300 U.S. banking institutions, payments processors and independent card issuers, will prove valuable to banks because it helps to highlight emerging fraud trends. But some say they hope future reports provide more details about the actual losses banking institutions suffered because of fraud linked to those payments -- not just the total value of the fraudulent transactions themselves.

Still, the data will provide the industry with a valuable baseline about payments fraud, giving banking institutions insights into areas where they need to improve fraud detection.

"Our payments study provides a helpful groundwork regarding ongoing payment trends," says Jim McKee, senior vice president of the Federal Reserve Bank of Atlanta, and one of key contributors to the study.

Questions about third-party fraud were added to the survey for the latest report because the industry expressed an interest in having more definitive data about payments fraud, he adds. Now in its fifth iteration, the Fed has been gathering data for its triennial Payments Study since 2000.

Third-party fraud, according to the Fed, results from any payments transaction that is conducted by someone other than the authorized user of the account or from a payment card that is used for a fraudulent transaction.

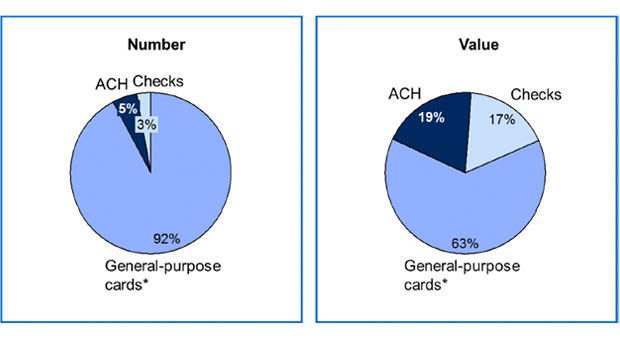

Comparison of Card Fraud to ACH and Check Fraud

SOURCE: Federal Reserve Bank

Card Fraud on Rise

In 2012, unauthorized credit, debit and prepaid card transactions represented 92 percent of the total number of unauthorized transactions identified by banking institutions. Those totals exclude cards that are issued by retailers for in-store shopping and prepaid cards issued for governmental benefits, the Fed notes.

The value of card-present fraud, which relates to transactions and purchases made at the physical point-of-sale, totaled $2.4 billion. By comparison, the value of card-not-present fraud, which is based on transactions conducted over the phone or online, totaled only $1.6 billion.